Household Finance Fears Worst Since COVID As Inflation Expectations Surged In April, NY Fed Survey Finds

Well if Fed Chair Powell couldn’t see the ‘flation’ before, perhaps he can now…

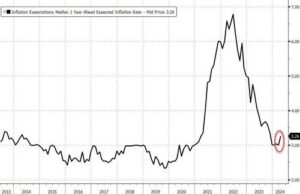

After flatlining around 3.,0% for the last four months the median one-year-ahead inflation expectations increased to 3.3%, according to The New York Fed’s April Survey of Consumer Expectations.

They also increased to 2.8 percent from 2.6 percent at the five-year-ahead horizon, while decreasing to 2.8 percent from 2.9 percent at the three-year horizon.

Home price expectations ticked up to 3.3 percent after seven consecutive months at 3.0 percent, reaching their highest level since July 2022.

Consumers also anticipated faster price growth for gasoline, food, medical care, a college education and rents, according to the New York Fed survey.

The data follow a string of reports that have indicated sticky inflation and a relentless run-up in home prices.

Data out this week is projected to show US consumer prices still rose at stubborn pace last month, and shelter has been consistently responsible for boosting measures of inflation.

All of which is hammering household budgets as the share of consumers that expect they’ll miss a minimum debt payment over the next three months is at the highest since the onset of the pandemic.

Finally, views of the labor market worsened, with earnings growth expectations decreasing and the probability of higher unemployment rising.

Respondents were also less confident in their ability to find a new job if they lost their current one, falling to the lowest reading in three years.

So – all things considered – not the shiny basket of awesomeness that ‘Bidenomics’ keeps being promoted as eh?

Tyler Durden

Mon, 05/13/2024 – 11:19

0 comments on “Household Finance Fears Worst Since COVID As Inflation Expectations Surged In April, NY Fed Survey Finds” Add yours →